Discover Cyprus

Cyprus Overview

Cyprus is the third largest island in the Mediterranean Sea, located at the eastern end of Europe, at the crossroads of the busy shipping and air routes linking three continents, Europe, Africa and Asia. The island, through its rich history of more than 10,000 years, has developed from its classical maritime communities into a modern and thriving European Union state, offering a myriad of opportunities for both economic growth and enviable quality of life.

This small but dynamic country has long established a reputation as a “centre of excellence” for international business activities, retaining unique clusters of expertise and service capability to support key growth sectors of the economy. Cyprus has a modern, free-market, service-based economy with an effective and transparent regulatory and legal framework offering international investors and domestic businesses confidence to invest, grow and prosper.

Capital

Nicosia

Languages

English & Greek

Area

9,251 sq km

Polulation

1,179,551 (2017 est.)

Time Zone

UTC +2

Government

Constitutional Democratic Republic

Weather

Average Annual Temperature 24 C

Sunshine

Average of 320 Days of Sun per Year

Strategic Location

The island of Cyprus is an ideal investment gateway to the European Union, as well as a portal for investment outside the EU, particularly into the Middle East, India and China. As a member of the wider EU and Eurozone community, Cyprus ensures safety and stability for investors, while also offering them market access to more than 500 million EU citizens.

A True Business Hub

Cyprus has long established itself as a thriving business hub, with a vast array of investment opportunities in key growth sectors of the economy. The island’s ideal strategic location, advanced infrastructure, and high quality of life not only represent key reasons to relocate and live in Cyprus, but are also at the heart of its attractiveness to investors.

Capitalizing on its competitive advantages, driving and enhancing both traditional and new economic sectors, and continuously improving and enhancing its business environment, Cyprus has developed into a destination of choice for doing business.

Living in Cyprus

Quality of Life

Cyprus offers visitors a wonderful living experience that combines a comfortable and stress-free way of life with a modern and sophisticated environment, ideal for people seeking the perfect balance between business and pleasure. High quality of life is without a doubt one of Cyprus’ most compelling advantages.

- Cyprus has the most “BLUE FLAG”-awarded beaches in Europe. In 2018, a total of 64 beaches have been awarded the Blue Flag, with beaches in Ayia Napa and Protaras being awarded with 22 Blue Flags.

- Cyprus boasts very high quality agricultural products, of which many are exported to Middle East and Asian Countries.

- Cyprus has one of the lowest pollution rates in the world.

Natural Beauty and Climate

Cyprus has a pleasant Mediterranean climate with year-round sunshine. Stunning coastlines, golden sandy beaches and clear, blue waters coexist alongside glorious mountains boasting wild natural beauty, and peaceful, picturesque villages. Sports enthusiasts can ski in February, swim and kite surf until December, and cycle, golf, and play tennis all year round.

Eastern Cyprus

Ayia Napa & Protaras

The Eastern coast of Cyprus offers visitors warm sunshine, stunning sandy coves, and friendly, welcoming taverns, all of which make this coast a classic beach holiday destination. Whether you’re looking to let your hair down and party until the early morning hours, or simply chill out and relax in a luxurious resort for some self-reflection and pampering, or even looking forward to a fun beach vacation with the entire family, there is something for everyone on this sunshine-filled island in the Mediterranean.

Population

60,000

Beaches

22 Rated Blue Flag

Tourist Hotel & Rental

47% of Cyprus Bookings are in Eastern Cyprus

Agriculture

Considered the best area for growing

Cyprus Infrastructure

The island benefits from a well-advanced and modern infrastructure which makes day-to-day life easy, cost-effective and efficient.

Cyprus Road Network

The Cyprus highway system connects all major cities. There are a total of three main highways in Cyprus, all of which merge together at various points. Though the first motorway in Cyprus, the A1, was completed as recently as 1985, the island already boasts the most kilometers of motorways per capita (38.6 km /100,000 inhabitants) of all European Union members.

Education

Legal System Transparency

Cyprus’ legal system, based on English Common Law principles, is widely recognized as a business-friendly and effective system that ensures transparency and reliability in business practices. Offering foreign businesses a familiar and reliable framework within which to operate, Cyprus’ legal system is also fully compliant with the EU, the Financial Action Task Force on Money Laundering (FATF), OECD, FATCA, the Financial Stability Forum laws and regulations and EU AML directives.

Human Talent

Human talent probably constitutes Cyprus’ most compelling advantage, complemented by a broad range of high quality professional services. As a dynamic business center, Cyprus offers an abundance of highly educated and skilled individuals, multilingual in their majority, ready to serve the needs of any business.

Indeed, Cyprus has all the right ingredients to maintain a strong and resilient economy, due to its small size, productive labor force, and business friendly and flexible government.

Safety

Cyprus offers an extremely safe living environment, with low stress levels and crime rates, ideal for a peaceful family life. Acknowledging the island’s safety and security standards, Value Penguin has ranked Cyprus 5th worldwide and 1st among smaller Countries in its Safest Countries in the World study for 2015.

Health

Cyprus, along with its clean environment and healthy cuisine, also has a robust health system, and was ranked the 11th healthiest country worldwide in 2015 as per Bloomberg. Hospitals and clinics are numerous and affordable, and Cyprus has become a premier retirement destination for UK and EU residents.

Business in Cyprus

Stable Legal System

Based on English Common Law Principles

Effective International Business Systems

Strategic Global Location

A Nexus for International Travel and Trade between Asia, Africa and Europe

Incentivized Taxation System

Corporate tax rate of 12.5%

Comprehensive double taxation agreements

Reliable Infrastructure

Stable European Government

Excellent Hard and Soft Infrastructure

INTERNATIONAL ORGANISATIONS WHICH OPERATE IN CYPRUS DUE TO FAVORABLE TAXATION:

Taxation & Benefits

Cyprus always endeavors to keep a clear and simple structure for taxation and fees when it comes to both business and property. Below you will find information on the taxes and fees surrounding ownership of a house or business in Cyprus. Should you have any additional questions, we are always happy to offer our expertise.

Registering a new company in Cyprus is considered preferable over any other EU country, especially for taxation purposes. See below for a breakdown of tax facts for Cyprus companies.

3rd Lowest in EU

Taxation of Dividends

Dividends received by a non-Cyprus Resident Company are exempted from Special Defense Contribution (SDC), if the dividend is paid out from less than 50% investment income. If not exempted, dividends are subject to 17% SDC.

Dividends received by a Cyprus Resident Company are exempted from corporation tax, whether received from a company situated in Cyprus or abroad.

Dividends received by a Cyprus Resident Company are also exempted from SDC, unless the dividends are paid out of profits that are more than 4 years old.

Capital Gains

Gains derived from the sale of shares are tax-exempt. Capital Gains tax is imposed on gains derived from the disposal of property situated in Cyprus, and on gains from the disposal of shares of an unlisted company that owns immovable property situated in Cyprus.

Company Registration Fees

The cost for the registration of a Cyprus company amounts to approximately 1,500EUR + VAT.

Rent

Rent paid by a Cyprus resident company is subject to SDC at a rate of 3% on 75% of the gross rental income. The tax is withheld at source. No tax is imposed on the payment of dividends to individuals who are Cyprus tax residents but are not domiciled in Cyprus.

Withholding Tax

DIVIDENDS

Dividends paid to a non-resident (individual and company) are NOT subject to withholding tax. No tax is imposed on the payment of dividends to individuals who are Cyprus tax residents but are not domiciled in Cyprus.

INTEREST

No withholding tax is imposed on interest paid to a non-resident. Interest paid to a resident is subject to SDC deducted at source at a rate of 30% (3% on government bonds). No tax is imposed on the payment of dividends to individuals who are Cyprus tax residents but are not domiciled in Cyprus.

ROYALTIES

Royalties paid to a non-resident are subject to a withholding tax of 5% on film royalties and 10% on other royalties. Royalties paid to a non-resident for the use of rights outside the Republic are exempt from withholding tax. There is no withholding tax on the payment of royalties by a resident company to another resident company

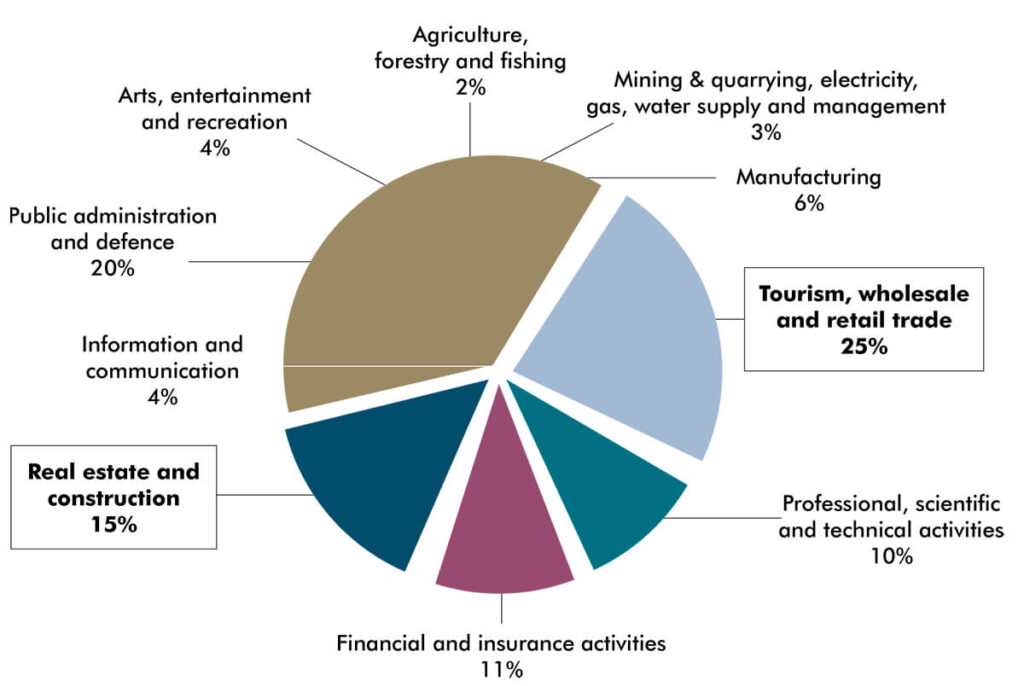

Key Pillars of the Economy

The tourism sector is one of the main drivers of the Cypriot economy, representing overall direct and indirect 25% of the Cypriot GVA in 2019. The total contribution of the retail, hospitality and leisure sector of Cyprus to the Cypriot GVA was c.19.5% in 2016.

The three main pillars of the Cyprus economy are tourism, wholesale and retail trade 25%, real estate & construction 17% and financial and insurance activities 8%.

Gross Value Added (GVA) Breakdown by Sector (2019)

Top 6 Accounting Firms Operating in Cyprus

The Big 6 refers to the five largest accounting firms in the world. These firms provide an extensive range of accounting and auditing services including external audit, taxation services, management and business consultancy, and risk assessment and control. They also provide massive employment and career development opportunities to accountants and auditors around the world. The following are the members of this internationally renowned group:

Luxurious Hotels and Resorts

The best places to stay in Cyprus are all found on the East Coast. Over 70 luxurious hotels and resorts and glorious white-golden bays have made the East Coast the ideal holiday playground for all ages, attracting thousands of solo travelers, couples, families and friends from all over the world. The tourism popularity of the East Coast has also attracted investors who have invested million euros in hospitality projects over the last years.

CYPRUS: The Key Sectors

The history of Sea and Shipping in Cyprus can be traced back thousands of years. The island’s expert knowledge of sailing and trade was acquired through the many civilizations that had conquered Cyprus in ancient times, including the Egyptians, Greeks, Romans, French, Venetians and British. The island’s constant strive for perfection in the field of merchant shipping has also been naturally facilitated by its ideal geographic location, at the crossroads of three continents, Europe, Asia and Africa.

Over the years, Cyprus has managed to attract the interest of shipping entrepreneurs and develop the country into a fully-fledged shipping center, combining both a sovereign flag and a resident shipping industry, which is renowned for its high quality services and standards of safety.

An Emerging Energy Player

The budding oil and gas sector of Cyprus has become one of the biggest opportunities for foreign investments, following the world-class discovery of natural gas and potential oil deposits in Cyprus’ Exclusive Economic Zone (EEZ) in the Mediterranean Sea.

Appraisal drilling in block 12 by US Company Noble Energy confirmed natural gas reserves of 4.54 trillion cubic feet (tcf) – enough to meet Cyprus’ domestic gas demand for over 100 years – and has attracted international energy heavyweights, such as Total, Eni and Exxon-Mobil, to explore the island’s waters for new discoveries. Cyprus’ energy sector currently presents one of the best opportunities for foreign investors and for economic growth.

Oil Resources

3.4 BBL

Natural Gas Reserves Discoverd

4.54 tcf equal to 600 blns USD

(more to be explored)

Karma Smart Investment Solution

EU Member Countries

Distance to member countries

Permanent Residency

Acquiring Cyprus Immigration Permit

CRITERIA

- Purchase of residential real estate of total market value of at least €300,000 (+VAT) of which, at the time of application, at least 2/3 is paid.

- Deposit of at least €30,000 into a Cyprus bank account, pledged for a period of at least three years.

- Provision of evidence of a secure annual income of at least €30,000 + €5,000 for each dependent child + €8,000 for each dependent adult, (spouse, parent or parent-in-law).

TRAVEL VISA INFORMATION

Should you wish to visit Cyprus during this process, you may need to acquire a short-term visa, which will grant you 90 days to visit the island. Cyprus has visa free and visa on arrival (VoA) agreements with 146 countries but many nationalities still need to acquire a visa before entering Cyprus. To find out the exact requirements for obtaining a short-term visa to Cyprus, you will need to contact the Embassy or Consulate of Cyprus in your country, or visit their website. However, the general procedure remains similar in all countries.

ACQUIRING CYPRUS IMMIGRATION PERMIT ADDITIONAL INFORMATION:

- This expedited process takes 3 months.

- If you or your spouse is an EU citizen or has a parent who is a Cyprus citizen, contact your local embassy to enquire about Cyprus residency regulations.

- The Immigration Permit does not allow the undertaking of any form of employment in Cyprus.

- Holders of an Immigration Permit must visit Cyprus once every two years.

- Non-financially dependent children of the applicant over the age of 18 may also be granted residency, so long as the market value of the acquired real estate is increased by at least €300,000 (+VAT) for each child

VISA FEES

Single Entry Visa : €20

Multiple or Double Entry Visa : €60

Permanent Residency Benefits

Highlights

One of the lowest personal and corporate tax rates in the EU

Strategic Global Location

A Nexus for International Travel and Trade between Asia, Africa and Europe

Incentivized Taxation System

Corporate tax rate of 12.5%

Comprehensive double taxation agreements

Reliable Infrastructure

Stable European Government

Excellent Hard and Soft Infrastructure